[ad_1]

With out F-Collection and Silverado, large Detroit manufacturers see

customer-return percentages drop

It has been an extended historical past of dueling pickups between the Ford

F-series and Chevrolet Silverado pickups to find out America’s

best-selling truck. And a giant a part of that continued success for

each manufacturers lies with model loyalty – typically over generations of

house owners.

However what occurs to Ford and Chevrolet model loyalty when these

fashions are faraway from the equation? The image turns into fairly

totally different.

Model loyalty measures how typically a family with a selected

model’s car returns to the identical model once they make their subsequent

new-vehicle buy, which could possibly be a substitute car or an

addition to the storage.

Ford model loyalty for the 2022 calendar 12 months was 58.6%. When

the F-series fashions – the F-150, F-250 and F-350 – have been stripped

out, model loyalty fell to 49.5%.

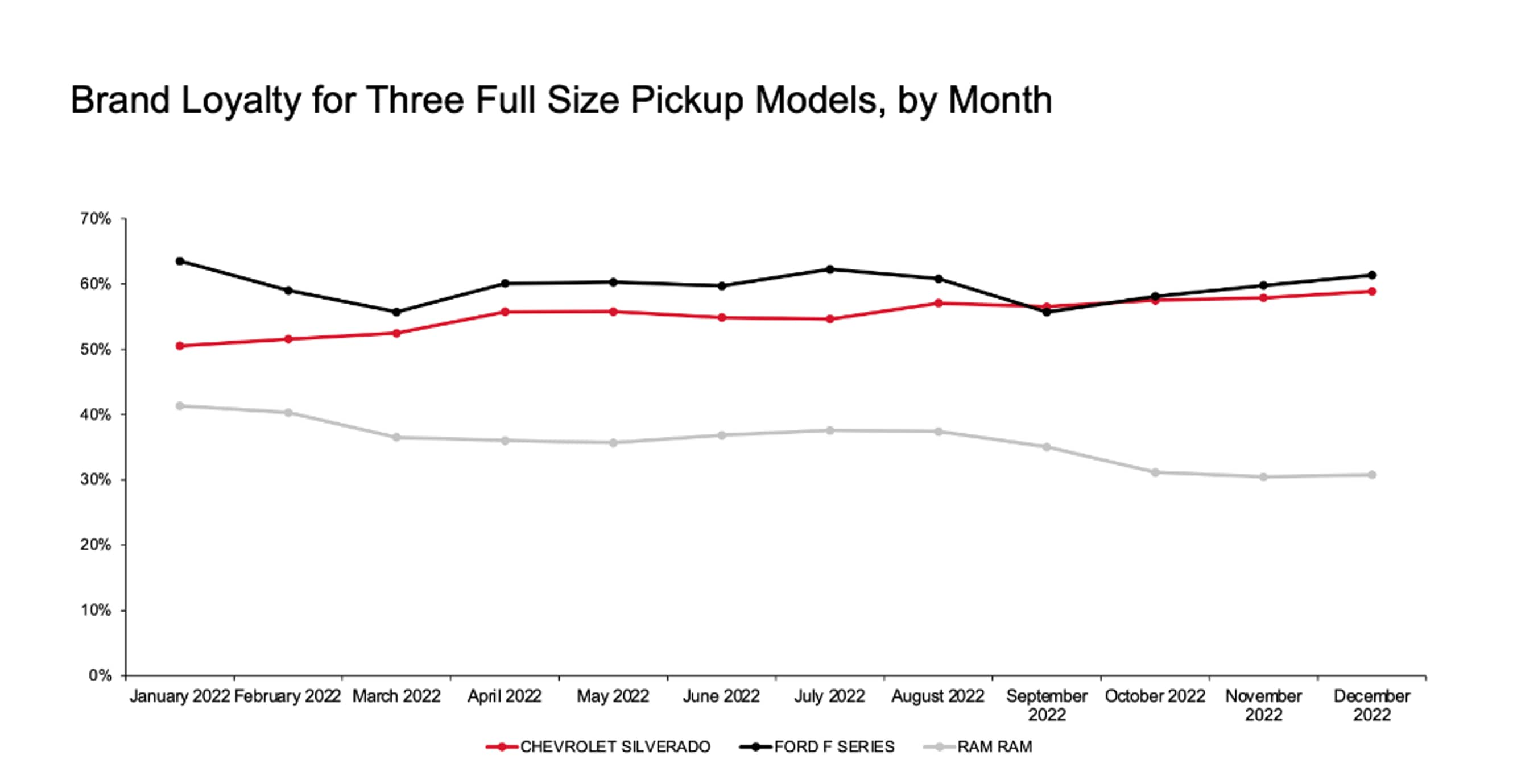

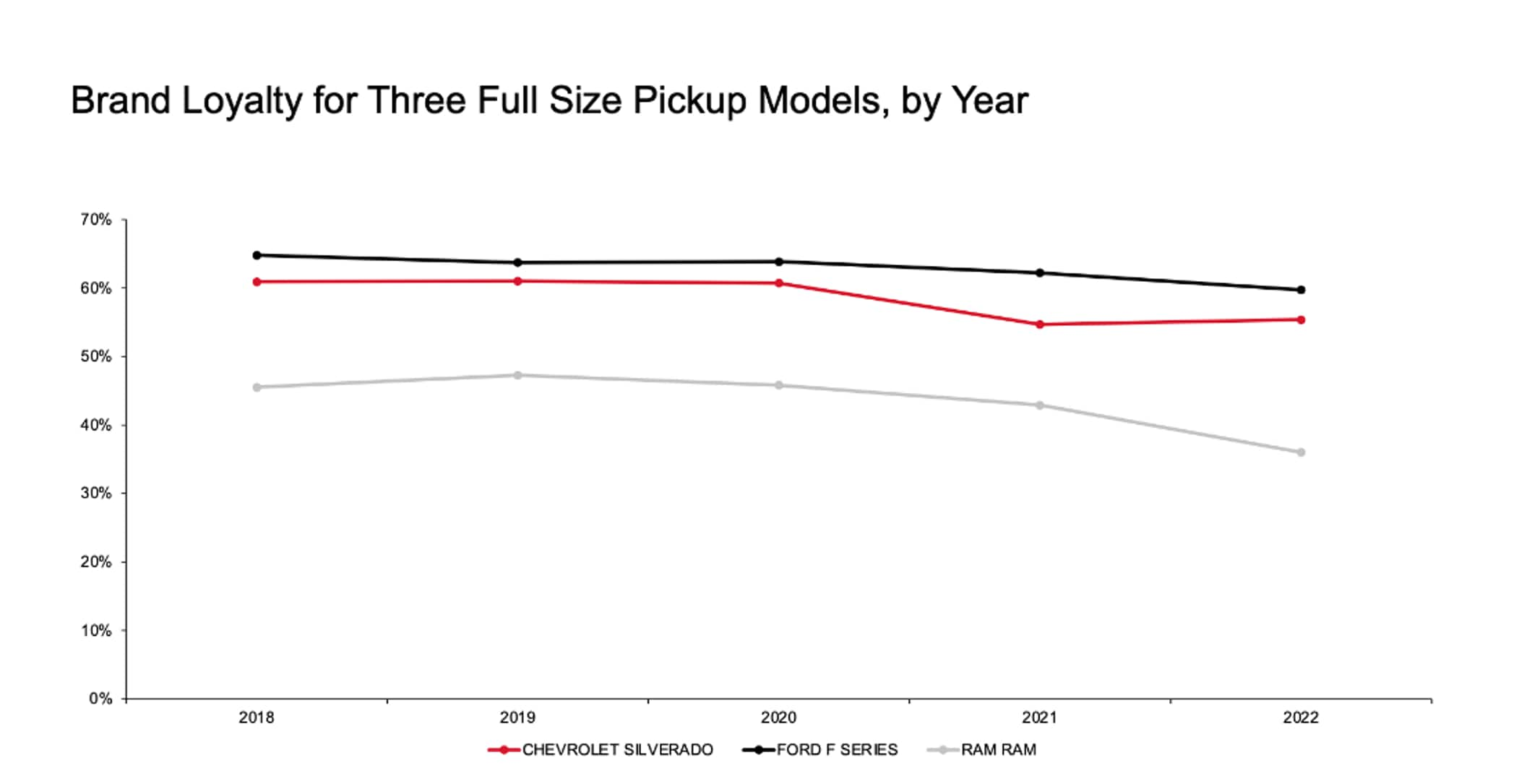

On the mannequin degree, house owners of a Ford F-series confirmed 62.2% model

loyalty in 2021 and 59.7% in 2022. Because the F-series is Ford’s

best-selling nameplate, it pulled the general model loyalty determine

upward by a whopping 9.1 share factors in 2022.

Equally, Chevrolet model loyalty in 2022 was 56.3%. When the

Silverado was eliminated, it fell to 47.9%. Silverado house owners, whereas

loyal, aren’t fairly on the degree of Ford house owners. Make loyalty for

all Silverado fashions in 2021 was 54.7%; in 2022, it rose to

55.4%.

(In the meantime, loyalty to the Ram light-duty pickup has slipped

from a pre-pandemic 47.3% loyalty in 2019 to 36% in 2022.)

Supply: S&P International Mobility

May the Chevrolet figures be considerably affected as a result of Basic

Motors additionally owns the GMC truck model? Not essentially. GMC’s 2022

loyalty price was 45.1%.

Detroit’s auto producers are cognizant of the loyalty of

their full-size pickup clients.

“The Ford, Chevy, Ram and GMC Sierra dominate the phase. They

know the worth of their entries on this phase, and they’re going to go

to intensive lengths to guard their place,” mentioned Tom Libby,

affiliate director of loyalty options and trade evaluation at

S&P International Mobility.

Limiting defections to rival manufacturers is essential, and right here the

F-Collection and Silverado do nicely, provided that roughly 2 million

full-size pickups are bought yearly. For the 12 months ending in

February, the Ford F-Collection had a web outflow – in different phrases,

defections minus conquests – to the Chevrolet model of a mere 5,914

households. In the identical interval, 2,315 extra F-Collection households

migrated to Ram than vice versa. In the meantime, the Silverado had a web

influx of 1,915 households from the Ford model. Silverado additionally

gained 688 earlier Ram house owners.

The F-series topped retail registrations within the US for 21 months

through the 36-month interval between January 2020 and February 2023;

nonetheless, the Silverado topped the listing for 10 months in that

interval. Longer-term, when together with retail and fleet gross sales, the

F-Collection has been the best-selling truck within the US for 46

consecutive years, in line with Ford-reported gross sales information.

Supply: S&P International Mobility

Model loyalty for mainstream manufacturers together with Ford and Chevrolet

declined from 56.6% in February 2020 to 50.6% in 2023. Luxurious model

loyalty dropped from 52% to 48.1%.

“The trade model loyalty hasn’t come again,” mentioned Libby. “Half

of that’s the stock is nowhere close to the place it was.”

This text was printed by S&P International Mobility and never by S&P International Rankings, which is a individually managed division of S&P International.

[ad_2]